Funding Sustainable Benefits for Active and Retired Members

Letter From the Executive Director

Dear STRS Ohio Members,

The State Teachers Retirement Board, as part of its ongoing focus on the financial condition of the pension fund, recently reviewed the results of two studies — an actuarial experience review and an asset-liability study — that are conducted every five years. These studies establish plan assumptions, measure the system’s actuarial accrued liabilities (benefits earned by active and retired members) and help determine how to invest system assets and how fast these assets are expected to grow. The results of these studies indicate that several factors, including lower than expected investment returns, longer lifespans among active and retired members, and lower than expected payroll growth continue to have a negative effect on the pension fund.

Accordingly, at its March meeting the Retirement Board approved changes to the actuarial assumptions that are used to calculate pension liabilities. The new assumptions outlined below are projected to add about $6.2 billion to STRS Ohio’s accrued liabilities and push its funding period — the time it would take to reach 100% funded status — to more than 50 years. Ohio statute requires STRS Ohio to have a funding period of no more than 30 years or to submit a plan to reduce its funding period to reach this target.

Segal Consulting, the board’s actuarial consultant, estimated that STRS Ohio would need to reduce benefits by about $10 billion to meet the 30-year funding target. The $10 billion figure takes into account the additional $6.2 billion in liabilities mentioned above, lower expected payroll growth and market returns being lower than the assumed rate of investment return in fiscal 2015 and 2016. At the April meeting of the State Teachers Retirement Board, the board made the difficult but necessary decision to reduce cost-of-living increases granted on or after July 1, 2017, to 0% to preserve the fiscal integrity of the retirement system. Benefit recipients’ base benefit and past cost-of-living increases will not be affected by this change. The board also agreed to evaluate — not later than the next five-year actuarial experience review — whether an upward adjustment of the cost-of-living increase is payable without materially impairing the fiscal integrity of the retirement system.

The cost-of-living adjustment (COLA) has a large financial impact on the pension fund because it affects both active and retired members of the system. This change is projected to keep STRS Ohio within the state of Ohio’s 30-year funding target and the Retirement Board’s own funding policy target. The COLA change and the impact of the new actuarial assumptions will be factored into the system’s annual actuarial valuation report, which will be delivered in October.

We know this is not welcome news to our members, and the board and staff understand the concerns expressed by members we have met with and heard from throughout Ohio. The following pages include additional information to help you understand the factors that led to the board’s decision in April. Much of this information has been shared in STRS Ohio’s Board News, a newsletter that summarizes actions and discussions that take place at monthly board meetings. Board News is emailed to all members who have an email address on file with the retirement system. If you do not currently receive these emails, we invite you to log in to your personal account on STRS Ohio’s website and add your email address to your contact information or contact our Member Services Center toll-free at 888‑227‑7877.

STRS Ohio’s mission is to partner with our members in helping to build retirement security. Please know that we are committed to funding sustainable benefits for active members and retirees of the system, and we will continue in our efforts to communicate with you openly and honestly about the health of the pension fund.

Sincerely,

Measuring the System’s Financial Strength — Key Terms to Know

The most common ways to express the system’s financial condition are through the funded ratio and the funding period. The “funded ratio” — expressed as a percentage — is the value of assets (funds available to pay benefits) compared to actuarial accrued liabilities (benefits earned by members of the system). The gap between the assets on hand and what is owed in benefits is called the “unfunded liability.” To calculate the liabilities, the retirement system makes educated estimates (also called assumptions) — based on the recent history of the membership — about our members and the benefits they will receive. These estimates include how long active members will teach, what kind of salary increases they will receive, how long benefit recipients will live in retirement, etc. There are also assumptions about how fast pension fund assets will grow.

The “funding period” is the amount of time needed to pay off, or “amortize” the system’s unfunded liability, assuming current contribution rates. Every five years (or sooner), STRS Ohio conducts an actuarial experience review to see how closely the system’s assumptions match what actually happened since the last experience review was conducted. In other words, the experience review measures the system’s economic and demographic assumptions versus actual results. Economic assumptions include the rate of inflation, salary increases, overall payroll growth and the investment return on assets. Demographic measures include retirements, disability inceptions, withdrawals and the number of deaths among active members and benefit recipients.

Results of STRS Ohio’s Actuarial Experience Review and Key Changes to Assumptions

Following the experience review, the system’s actuary makes appropriate “best estimate” recommendations to the board for each assumption. The Retirement Board then votes on assumptions. Following is a summary of key changes to the assumptions approved by the board in March:

- Reduced expected investment return to 7.45% from 7.75% — this recognizes projections for modest global economic growth and lower expected returns for capital markets. Impact: increases liabilities.

- Change to updated generational mortality tables — recognizes that STRS Ohio members are living longer and STRS Ohio is paying benefits for a longer period of time than expected. Also accounts for this trend continuing in the future. Impact: increases liabilities.

- Reduced inflation assumption to 2.5% from 2.75% — affects expected investment return, payroll growth and individual salary increases. Impact: measured in other areas noted.

- Reducing salary growth scale for merit and seniority, and for inflation — reflects that individual teacher salary increases were lower than expected. Impact: decreases liabilities.

- Reducing overall payroll growth to 3% from 3.5% — recognizes that there will be less money coming into the fund through member and employer contributions than expected. Impact: lengthens the funding period.

Segal Consulting’s latest calculations show STRS Ohio’s funding period is 57.7 years and STRS Ohio’s funded ratio is 62.6%. As a result, the Retirement Board needed to take action to comply with Ohio law and improve the pension fund’s ability to pay benefits for the long term for all of STRS Ohio’s members.

Results of STRS Ohio’s Asset-Liability Study

STRS Ohio’s asset-liability study began in August to help the board determine reasonable risk and return expectations for the investment portfolio. These studies are typically conducted every three to five years to acknowledge change and uncertainty in the capital markets and to confirm an investment policy to meet return and risk objectives in relation to funding, accounting and policy goals.

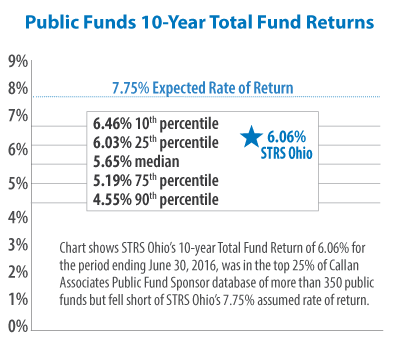

Following completion of the study conducted by the Retirement Board’s investment consultant, Callan Associates, the board selected a new asset mix for the system’s total fund. The new asset mix is designed to provide lower volatility, increased liquidity and diversification and a slightly lower expected rate of return. Callan projects the new asset mix to earn a return of about 6.84% over the next 10 years, but said returns could be higher over a longer time horizon. The asset mix includes investments that will be easier to convert to cash when benefit payments are due each month.

The current and new asset mix targets are shown in the table below. STRS Ohio’s investment staff will begin to develop acceptable target ranges for each asset class and will incorporate the newly approved asset mix target in its Investment Plan before implementing the changes.

| Asset Class | Current Target | New Asset Mix Target |

|---|---|---|

| Broad U.S. equity | 31% | 28% |

| Broad international equity | 26% | 23% |

| Broad U.S. fixed income | 18% | 21% |

| Real estate | 10% | 10% |

| Private equity | 7% | 7% |

| Opportunistic/diversified | 7% | 10% |

| Liquidity reserve | 1% | 1% |

STRS Ohio Addresses Questions About System Funding

Who is affected by the reduction in the cost-of-living increase?

The cost-of-living increase will be reduced to 0% for all benefit recipients. The change will take effect beginning July 1, 2017, and will remain in place until the Retirement Board approves an adjustment in the future. Not later than the next five-year experience review (expected to be in 2022), the board will evaluate whether an upward adjustment of the cost-of-living increase is payable without materially impairing the fiscal integrity of the retirement system.

Why is STRS Ohio’s unfunded liability so large?

STRS Ohio was 91.2% funded as of July 1, 2001, before two broad market downturns in 2001–2002 and the great recession of 2008–2009. The unfunded liability increased from $5.2 billion in 2001 to $46.8 billion in 2012 and the funded ratio dropped to 56%. Pension reform was implemented in 2012 to reduce the unfunded liability to $31.8 billion, but the recent change to STRS Ohio’s actuarial assumptions increased the liabilities to more than $37 billion.

Why did the board change the investment return assumption?

STRS Ohio needs realistic assumptions so the plan to pay off the unfunded liability is realistic. If assumptions are too optimistic and the long-term experience doesn’t match those assumptions, the subsequent changes to the benefit structure that would be required would be even more substantial. STRS Ohio’s investment consultant, along with other consultants used by pension funds around the country, expect a low-return environment for the next decade or more, making a 7.75% return unlikely.

The stock market performance has been strong this year — hasn’t STRS Ohio benefited from the market rebound?

STRS Ohio has benefited; however, while market indices did reach all time highs earlier this year, they are far below the expected level following years of low returns. In its most recent report, CEM Benchmarking, an independent firm that conducts investment analysis, showed STRS Ohio’s five-year investment rate of return ranked in the top 25% of its U.S. public fund universe. Even with continued strong performance, STRS Ohio cannot invest its way out of the funding challenges it has. And while it’s true that the U.S. equity market is performing well of late, it’s important to remember that STRS Ohio has a diversified portfolio and about 30% of assets are in U.S. public equities. The board’s independent investment consultant, Callan Associates, shared with the board during the asset-liability study, investment policy alone cannot fill the funding gap.

It’s also worth noting that when STRS Ohio assets peaked in 2007, the system was not fully funded. And since then, the Retirement System has paid more than $51 billion in service retirement, disability and survivor benefits while contributions totaled about $23.7 billion. Our return assumption was 7.5%–8% every year thereafter. Instead, the Great Recession happened, and the U.S. stock market took nearly five years just to get back to where it was.

What are the board and staff doing to control expenses?

The board and staff have taken many steps over the past 15 years to control expenses. Staff head count peaked at 735 associates in the early 2000s and now stands at about 544 associates. About 100 of those associates are professional staff that manage investments. The cost to STRS Ohio would be much more if instead we used external money managers. The current year operating budget of $96.9 million is about $2 million below the 2008–2009 budget, when Michael Nehf became executive director.

Even with the reduced head count, STRS Ohio has maintained its commitment to high customer service. Last year, STRS Ohio was recognized by CEM Benchmarking as #1 in customer service compared to nearly 60 participating systems in the United States, Canada and Europe. CEM’s investment benchmarking analysis showed STRS Ohio’s investment costs are second lowest in our peer group, while returns for the five-year period studied ranked in the top quartile. Investment costs are low because STRS Ohio uses more internal management than its peers. The study cites this use of internal management saved STRS Ohio about $102 million in 2015 (compared to the peer group’s median external management costs) — more than STRS Ohio’s entire operating budget for the year.